There’s no sugar-coating it; the past year has been an especially terrible year for freight. And the beginning of 2024 has been no picnic, either. But according to market analysts, there is a glimmer of light at the end of the long tunnel in this great freight recession we’ve been enduring.

As we inch closer to the end of the first quarter of 2024 we look toward the (usually) busier spring season for some signs of life in the freight market. Traditionally, spring brings at least a slight boost to the freight economy as seasonal purchases such as home improvement and gardening needs increase. Reefer trailers are tied up with produce in the late spring and summer, providing van carriers with some extra freight. While we didn’t see that boon last year, indicators show that we might start seeing that again this year.

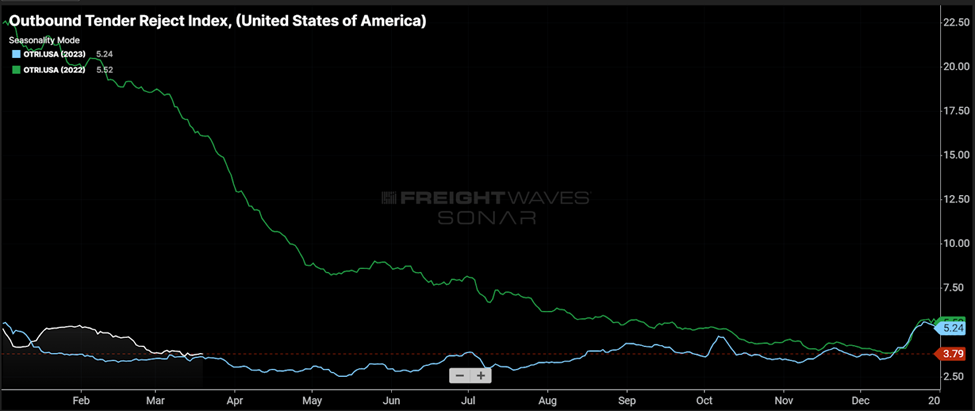

One tool that quickly shows the strength of the market is the Outbound Tender Reject Index, produced by the trucking industry company Freightwaves. This just measures how much-contracted freight carriers are declining from their customers. The more freight they decline, the better the market is for carriers as they are getting other freight or better offers. Conversely, the fewer freight carriers are declining, the fewer options they have and the more dependent they are on everything they can get.

To have an idea of when the market will turn requires a little background on how we got to this position in the first place. The major sectors which affect trucking freight are industrial production, construction, and consumer goods. When the demand for any of these is down, trucking will be affected. When the Covid pandemic hit, the government went on a spending spree, printing trillions of dollars in the forms of “stimulus” and “recovery” payments. Consumers then also went on spending sprees. The result was a boon for the trucking industry. Trucking companies bought more equipment and hired more drivers; brokerages popped up overnight to cover the excess freight. However, the hangover has lasted a lot longer than the party. All the spending created record inflation. When people have trouble just paying their bills, they’re not spending. The inflation has caused interest rates to surge; people aren’t buying homes and homes aren’t being built. Retailers have huge inventory gluts that are still holding strong from the pandemic splurge. All that adds up to a slow economy and less demand for trucks.

The good news is that inventories are beginning to return to normal, pre-pandemic levels. Analysts believe that freight rates have hit the bottom and probably won’t plunge any further. The market is currently saturated with trucking companies and as the less-resilient companies leave the market due to economic conditions, rates will go up for those still around.

Marvin Keller has endured every freight downturn and will continue to do so. We are constantly innovating; every day we source and gain new customers and drivers and we optimize our network so we will be in a prime position to thrive once the market turns. Right now, the market is saturated with drivers. With more and more truckers chasing a limited supply of loads, competition is tough and prices are low. In order to stay competitive in this market, drivers must step up their game and focus on providing customers with the best service possible.